Accounting is an important and indispensable part of all business activities. Whether you are a newly established business or a long-standing business, you always need a complete, accurate, safe, and secure accounting system. To have such an accounting system requires high human resources and funding, as well as a complete accounting system that can adapt to rapid changes in the law. However, this requirement is a difficult problem for small and medium-sized enterprises today in Ho Chi Minh City.

Facing the consideration of budget issues for business expenses. You will have difficulty choosing the best option for your business. Every option has its opportunity cost, and we bring you an optimal option for small and medium-sized businesses today: choosing a reputable full-package accounting service in Ho Chi Minh City.

Full accounting service is a special service to support businesses with the most complete, professional, and reliable accounting system. Businesses can operate freely without worrying about recording economic transactions, accounting books, or tax agency reports. All documents arising from the business will be checked and promptly updated by a team of professional and experienced accountants to ensure compliance with local laws.

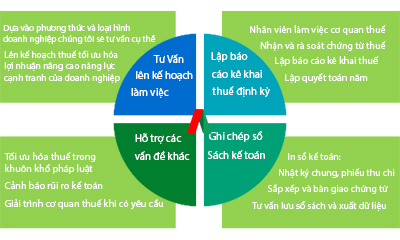

1. Consulting on work planning.

With more than 10 years of experience, we will provide detailed advice on the most suitable accounting, financial, and risk management systems for each type of business and different operating methods.

Tax planning to optimize the amount of tax payable within the framework of the law. Depending on the business situation, we will advise on the most beneficial tax plan for making business decisions.

2. Tax declaration report.

Receive and check accounting documents.

Output and input VAT invoices, bank supplementary books, payroll, and other related documents

Inventory and check documents to provide feedback to businesses on information that needs to be adjusted or supplemented.

Tax declaration and reporting according to regulations

Carry out tax declarations, monthly and quarterly tax reports, provisional income reports, and invoice usage. Then submit it to the tax authority according to the regulations.

Annual settlement

Based on all valid invoices and documents in the year, calculate and balance revenue and expenses in a reasonable manner to create a financial statement and annual settlement.

3. Record accounting books

- After completing the annual settlement report, the accountant prints detailed books, general journals, receipts, payments, imports, exports, etc. and completes the closing of the books to send to the business.

- Invoices and bank ledger documents will be neatly arranged and returned to the enterprise for storage.

- In addition, we will show how to keep books and retrieve data when businesses need it.

4. Support and handle other issues.

Provide consulting to help businesses minimize the amount of tax they have to pay within the legal framework.

Warn about potential risks and work with the business to come up with a timely and effective solution.

When the tax authority checks or conducts a tax inspection, our accounting team will work directly with the tax authority to resolve all tax-related issues in the business.

In addition, reputable full-service accounting services in Ho Chi Minh City also support financial reporting and bank loan applications.

Cost savings

There is no need to invest in facilities for accounting staff, such as desks and chairs, offices, computers, electricity, and water, or in the costs of building internal accounting software.

Operate with peace of mind

Complete peace of mind about accounting books, professionally served by our customer care team. You can retrieve data whenever needed.

Experienced staff

Work with a team of experts and skilled and experienced staff to solve problems that arise with tax authorities and other agencies.

Optimal solution

Above all, businesses will access a comprehensive solution to optimize taxes and improve business competitiveness.

Email: [email protected]

Hotline: 0909 506 567